Less than rosy economic numbers dog Biden

Published in Political News

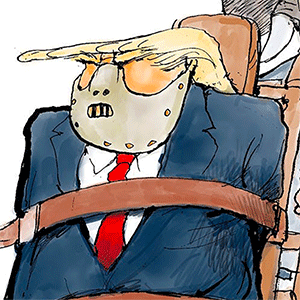

The Jimmy Carter years were marked by high interest rates, rampant unemployment, soaring inflation and weak economic growth. President Joe Biden is now hitting .750 in his effort to replicate the economic performance of the one-term president from Georgia.

On Thursday, the Commerce Department revealed that gross domestic product grew at a paltry 1.6% annual rate in the first three months of the year, down significantly from the end of 2023. Meanwhile, inflation almost doubled over the quarter to a 3.4% annual rate.

Despite Biden’s best efforts, we’re not in the dismal Carter years, which featured double-digit price hikes, interest rates beyond 20%, joblessness hovering near 8% and a shrinking economy. Biden has indeed presided over a low unemployment rate and robust job market. But his policies have also succeeded in pushing inflation to 40-year highs, doubling interest rates and slowing growth.

Can stagflation be far behind?

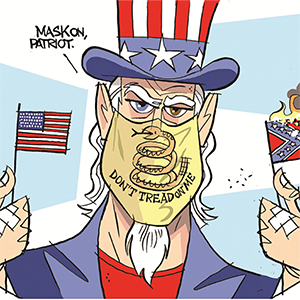

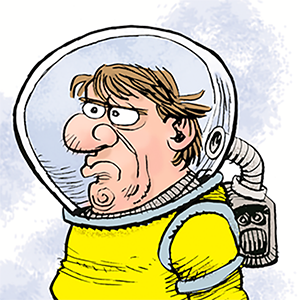

The president and his economic advisers insist that the unease Americans feel about the economy is the result of insufficient “messaging.” That if only voters would educate themselves about all the wonderful federal programs and projects this administration has created, they would see the light and flock to support Biden’s agenda of green cronyism. But perhaps Americans have a better understanding of the reality on the ground than do the central planners in the White House.

“There are mounting signs that high borrowing costs are weighing on Americans’ financial well-being,” The New York Times noted recently. “Consumers saved just 3.6% of their after-tax income in the first quarter, down from 4% at the end of last year and more than 5% before the pandemic. The signs of strain are particularly acute for lower-income households. They have increasingly turned to credit cards to afford their spending, and with interest rates high, more of them are falling behind on their payments.”

The uptick in inflation is also a concern. American families have struggled since 2021 with higher prices for basic staples, including food and gasoline. They see the real numbers as they move through the checkout lane. Inflation has slowed from its high of near 9% in the summer of 2022, but baseline prices remain elevated and are now heading north again. At the same time, The Wall Street Journal reports, inflation-adjusted hourly earnings “remain below the level when Biden took office.”

An April poll by Reuters found that 41% of respondents trusted Donald Trump over Biden on the economy. Just 34% gave the opposite answer. This continues to be a confounding puzzler for progressives and the White House. But when a modest lunch out now costs $20, filling the tank requires a C-note and grocery prices are up 25% over the past four years, even Inspector Clouseau could unravel the mystery.

©2024 Las Vegas Review-Journal. Visit reviewjournal.com.. Distributed by Tribune Content Agency, LLC.

Comments